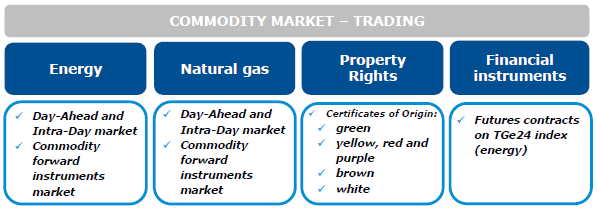

The activity of the GPW Group on the commodity market is concentrated in the Polish Power Exchange Group which is comprised of TGE, its subsidiary the Commodity Clearing House, as well as the OTC platform InfoEngine. The activities of the Polish Power Exchange includes:

- operation of a commodity exchange which offers trade among others in:

- electricity,

- natural gas,

- emission allowances,

- property rights in certificates of origin of electricity, certificates of origin of biogas and energy efficiency certificates

- commodity derivatives settled in cash;

- operation of the Register of Certificates of Origin and the Register of Guarantees of Origin;

- clearing of transactions on the commodity exchange;

- operation of an OTC commodity trading platform.

TRADING

Trade on TGE commodity markets

Electricity Market

Day-Ahead and Intra-Day Market

The Day-Ahead and Intra-Day Markets are markets in electricity with physical delivery and offer short-term electricity buy and sell transactions (spot market). The Day-Ahead Market market lists hourly instruments for each hour of delivery day as well as block instruments. Trade on the Day-Ahead Market takes place two days before and one day before the day of delivery. Trade on the Intra-Day Market takes place one day before the day of delivery and on the day of delivery.

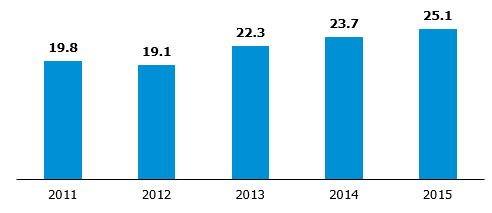

The volume of spot trade in electricity was 25.1 TWh in 2015, an increase of 5.9% year on year and a historical high. The average price on the Day-Ahead Market was PLN 155.66 per MWh in 2015, compared to PLN 184.75 per MWh in 2014.

Volume of trade in electricity on the Day-Ahead and Intra-Day Market (TWh)

Commodity Forward Instruments Market in Electricity

The Commodity Forward Instruments Market in electricity offers trade in standard forward instruments for delivery of the same quantity of electricity on every hour of delivery. Contracts are executed on a weekly, monthly, quarterly and annual basis.

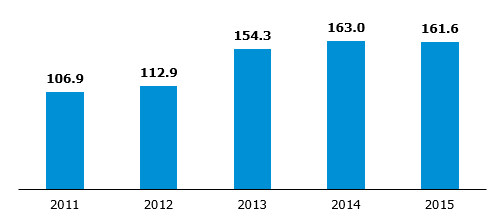

The volume of trade in electricity on the Commodity Forward Instruments Market was 161.6 TWh in 2015, a moderate decrease of 0.9% year on year. The price of the most liquid contract BASE_Y+1 decreased year on year as a result of falling prices on the reference market (Day-Ahead Market).

Volume of trade in electricity on the Commodity Forward Instruments Market (TWh)

Gas Market

Day-Ahead and Intra-Day Market in Gas

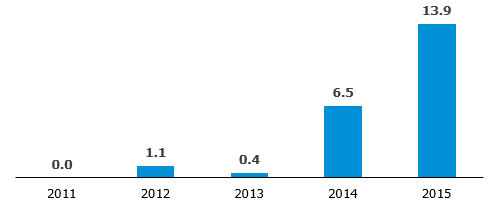

In December 2012, TGE launched a spot market in natural gas and opened trade on the Day-Ahead Market in Gas. The Day-Ahead Market in Gas lists the following types of contracts: BASE with delivery on 24 hours of the next day of the same quantity of gas in every hour of the day, and WEEKEND with delivery on two days (Saturday and Sunday) of the same quantity of gas in every hour of the day (between 47 and 49 hours). On 30 July 2014, TGE launched the Intra-Day Market in gas. The Intra-Day Market in gas lists hourly instruments with delivery on the day of trading.

The total volume of trade on the gas spot markets was 13.9 TWh in 2015, representing a share of 13% in the total volume of the gas market. The share increased by 7 percentage points year on year. The high share of the Day-Ahead and Intra-Day Market in Gas suggests that TGE is a highly liquid trading platform for the balancing market. The spot market also performs an important role for the operator Gaz-System whose regulations include a formula for the calculation of the average settlement price for balancing.

Volume of trade in natural gas on the Day-Ahead and Intra-Day Market (TWh)

Commodity Forward Instruments Market in Gas

Since 20 December 2012, TGE offers trade in forward instruments with physical delivery of natural gas on the Commodity Forward Instruments Market. It offers trade in standard forward products for delivery of natural gas in the same quantity in the exercise hours on a weekly, monthly, quarterly, seasonal and annual basis. Trade is available in BASE contracts with delivery of gas on 24 hours of the day.

The total volume of trade on the Commodity Forward Instruments Market in gas was 92.9 TWh in 2015, a decrease of 11.5% year on year. This was due to the launch of the company PGNiG OD in mid-2014. In Q3 and Q4 2014, PGNiG OD hedged current gas supplies to more than 6 million customers and future supplies with futures for the subsequent periods, i.e., the years 2015 and 2016 and seasons in those years. In view of the warm winter in 2014 and 2015 as well as market liberalisation, demand for gas decreased among market participants using gas for energy. With flexible production, customers using gas for purposes other than energy may buy gas at an attractive price. Traders are in a difficult position: the demand decreased but they have contracted gas on the futures market and balance the supplies on the spot market.

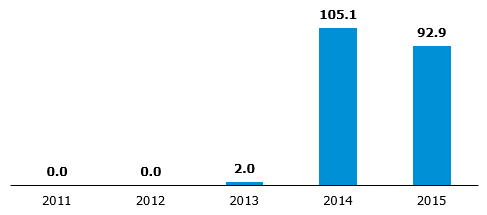

Volume of trade in natural gas on the Commodity Forward Instruments Market (TWh)

Property Rights Market

TGE operates a Property Rights Market in certificates of origin of electricity produced:

- from renewable energy sources (PMOZE and PMOZE_A, known as green certificates),

- in high-efficiency cogeneration (PMGM, known as yellow certificates; PMEC, known as red certificates; and PMMET, known as purple certificates),

Furthermore, the Property Rights Market lists:

- property rights in certificates of origin of biogas (PMBG, known as brown certificates), and

- property rights in energy efficiency certificates (PMEF, known as white certificates).

The Property Rights Market is a part of the support scheme for producers of energy from renewable energy sources. It allows producers of energy from renewable energy sources, cogeneration, biogas and holders of energy efficiency certificates to sell property rights, and energy operators required to pay substitution fees or to cancel certificates of origin to meet that obligation.

The volume of trade on the Property Rights Market is driven by the number of certificates issued in the Register of Certificates of Origin: increased production of energy generates the obligation to issue more certificates of origin, which in turn generates an increase of the volume of certificates of origin available on the market.

The total volume of trade in property rights for electricity was 58.9 TWh in 2015, an increase of 63.6% year on year.

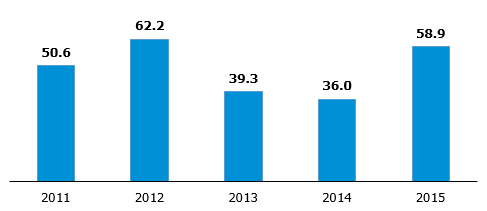

Volume of trade in property rights to certificates of origin (TWh)

The volume of trade in property rights in certificates of origin of electricity generated from renewable energy sources was 26.2 TWh in 2015, a decrease of 17% year on year.

The volume of trade in certificates of origin of energy from cogeneration,1 i.e., red and yellow certificates, was 25.2 TWh (an increase of 899% year on year) and 6.6 TWh (an increase of 979.8%), respectively, in 2015. The dramatic increase in trading was mainly driven by changes in the legal environment of the energy industry. The statutory support scheme for producers of energy from high-efficiency cogeneration (PMEC and PMGM) expired at the end of March 2013. The vast majority of transactions in 2013 took place in Q1 in keeping with the obligation for 2012, the last full year of the statutory obligation. The obligation to cancel certificates of origin of energy produced in high-efficiency cogeneration was reinstated in 2014 and the first transactions in the resumed system took place in late July 2014, hence the low volume of trade in cogeneration certificates in 2014.

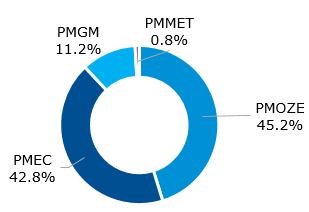

Purple certificates of origin of energy (PMMET) are issued for energy produced in units fired with methane gas released and sequestered in mine work in coal mines that are active, are under liquidation or have been liquidated, as well as gas from processing of biomass. It is the smallest cogeneration segment: the volume of trade in purple certificates was 0.5 TWh, accounting for only 0.8% of the total turnover in property rights.

In January 2016, TGE introduced to trading futures on property rights in certificates of origin of energy generated from renewable energy sources, which allow market participants to hedge prices and deliver property rights in the future. RES futures are addressed to all participants of the electricity market and are cleared by the Commodity Clearing House.

[1] Cogeneration – technological process where electricity and heat are generated simultaneously in a combined heat and power plant. Thanks to lower consumption of fuel, cogeneration provides material economic benefits and environmental advantages over separate generation of heat in a traditional heat plant and of electricity in a condensation power plant

Structure of the volume of trade in property rights in 2015 by type of certificate

In 2014, TGE introduced to trading energy efficiency certificates (PMEF – white certificates). The volume of trade in the certificates was 82,336 toe in 2015.

REGISTER OF CERTIFICATES OF ORIGIN

The Register of Certificates of Origin is a system of registration and recording of:

- certificates of origin which confirm that electricity was generated in high-efficiency cogeneration;

- certificates of origin which confirm that electricity was generated from renewable energy sources (RES);

- certificates of origin which confirm that agricultural biogas was produced and introduced to the gas distribution network;

- energy efficiency certificates which confirm that the project improved energy efficiency;

and recording of property rights under such certificates.

The main functions of the Register of Certificates of Origin include:

- to identify entities entitled to property rights in certificates of origin;

- to identify property rights under certificates of origin and the corresponding quantity of electricity;

- to register certificates of origin and the resulting property rights;

- to record transactions in property rights and balances of property rights in certificates of origin;

- to issue documents confirming property right balances in the register, used by the Energy Regulatory Office for cancellation of certificates of origin.

Certificates Issued and Cancelled (Register of Certificates of Origin)

RES – Green Certificates

The number of certificates issued and cancelled in 2014 was record-high. Following turbulences around the issuance of green certificates for electricity produced in biomass installations, a large volume of issued certificates was delayed from 2013 to 2014, resulting in a record-high volume in 2014.

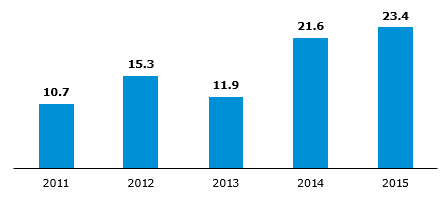

The volume of green certificates issued in 2015 exceeded the record-high volume of 2014, partly due to regulatory amendments designed to replace the existing support scheme with auctions. A large volume of new RES installations was commissioned by investors before the end of 2015 in order to still be covered by the existing support scheme. As a result, the volume of green certificates issued in 2015 was 23.4 TWh, an increase of 8.0% year on year.

Volume of issued RES property rights (TWh)

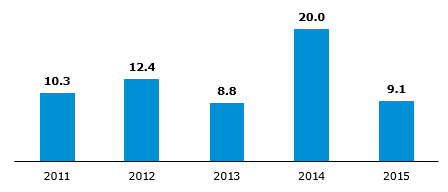

The volume of certificates cancelled in a year is decided by the Energy Regulatory Office (ERA). TGE received exceptionally few cancellation decisions from ERA in 2015. The total volume of green certificates cancelled in 2015 was 9.1 TWh.

Volume of cancelled RES property rights (TWh)

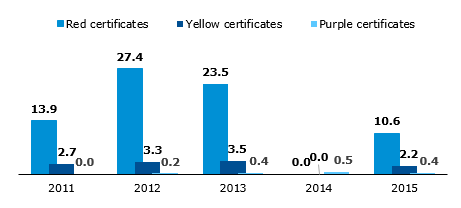

Cogeneration: Red, Yellow, and Purple Certificates

Mandatory cancellation of red certificates (PMEC) and yellow certificates (PMGM) expired in 2012. It was reinstated under an amendment of the Energy Law as of 30 April 2014. The Law clearly provides which certificates can be used to fulfil the obligation. Transactions in cogeneration certificates (for production as of 30 April 2014) were not executed until July 2015, which explains the low volume in 2015.

The total volume of cogeneration certificates issued in 2015 was 27.3 TWh, an increase of 32.7% year on year.

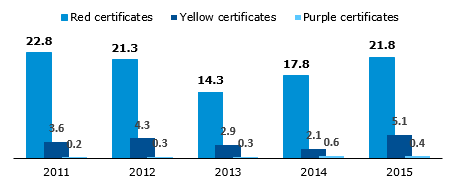

Volume of issued cogeneration property rights (TWh)

The total volume of red, yellow, and purple certificates cancelled in 2015 was 13.2 TWh, compared to 0.5 TWh in 2014.

Volume of cancelled cogeneration property rights (TWh)

Energy Efficiency: White Certificates

The second and third tender for white certificates took place in early and late 2015. As a result, the volume generated in both services provided by TGE was many times higher than in 2014. The total volume of white certificates issued in 2015 was 204,795 toe. The volume of cancelled certificates was 37,537 toe.

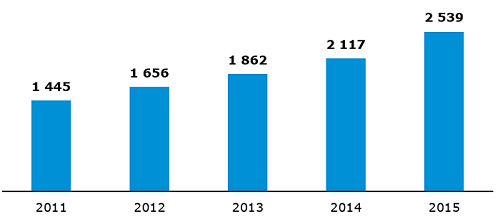

Number of Participants of the Register of Certificates of Origin

The Register of Certificates of Origin had 2,539 participants at the end of 2015. In 2015, 422 companies were accepted by the TGE Register Department (255 companies in 2014). Many of the new participants are beneficiaries of the system of white certificates, i.e., energy efficiency certificates. The increase was also driven by changes in the legal environment: following the enactment of Chapter 4 of the Renewable Energy Sources Act and modifications to the support scheme for producers of energy from renewable sources, many market players were keen to complete investment projects before 1 January 2016 (after the amendment of the Renewable Energy Sources Act, the effective date of Chapter 4 was postponed by six months).

Number of participants of the TGE Register of Certificates of Origin

NUMBER OF TGE MEMBERS

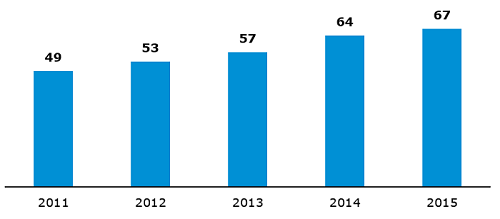

The number of TGE members is growing steadily, boosting growth of the markets operated by TGE and their trading volumes. At the end of 2015, TGE had 67 members, including 48 members of the electricity markets, 22 members of the gas markets, and 44 members of the Property Rights Market.2

[2] Some of TGE market members are active on more than one market

Number of TGE members

REGISTER OF GUARANTEES OF ORIGIN

TGE’s strategy is to grow, develop the best solutions for market participants, and promote solutions which gradually align the Polish market with EU standards

Directive 2009/28/EC which imposes the obligation to set up registers of guarantees of origin in the European Union member states was implemented in Poland in an amendment of the Energy Law of 26 July 2013, known as the small energy tripack, effective as of 11 September 2013. It requires TGE to operate a Register of Guarantees of Origin and to organise trade in guarantees of origin.

In September 2014, TGE launched the Register of Guarantees of Origin which registers energy from renewable sources and OTC trade in environmental benefits of its production. Unlike certificates of origin, guarantees do not involve property rights or a support scheme for renewable energy sources: they are issued for information only. There is no obligation to acquire guarantees but they can be used by entities to prove that a certain quantity of consumed energy was generated from renewable sources. TGE offers trade in guarantees of origin of energy since November 2014.

According to the regulations, the Energy Regulatory Office issues guarantees of origin which are then uploaded to the IT system of the Register of Guarantees of Origin operated by TGE. System users can trade in guarantees of origin or transfer them to end users as proof that energy was generated from renewable sources.

The year 2015 was the first full year of operation of the Register, and the volumes increased substantially. This was driven by rising interest of energy producers as well as better information and organisation on the supply side. The stronger activity of traders in guarantees of origin and end consumers was also driven by a major reduction of registration fees, which TGE intends to maintain for at least part of 2016. The number of participants of the register increased significantly from 56 at the end of 2014 to 157 at the end of 2015.

Register of Guarantees of Origin – comparison of 2014 and 2015

| Issued | Sold | Transferred | |

|---|---|---|---|

| Unit | TWh | GWh | GWh |

| 2014 | 4.87 | - | 11 |

| 2015 | 7.23 | 635 | 732 |

| Growth YoY | 48% | - | 6594% |

| 2014 | 4.87 | - | 11 |

| 2015 | 7.23 | 635 | 732 |

| Growth YoY | 48% | - | 6594% |

FINANCIAL INSTRUMENTS MARKET

In February 2015, TGE was authorised by the Minister of Finance to operate a financial instrument exchange. The decision of the Minister of Finance allowed TGE to open market consultations on the structure of new instruments. As a result, following the approval given by the Polish Financial Supervision Authority for the terms of trade in electricity futures programmes, TGE launched the Financial Instruments Market in November 2015.

TGE’s strategy is to grow, develop the best solutions for market participants, and promote solutions which gradually align the Polish market with EU standards

Market participants were offered trade in futures based on electricity prices, later to be followed by instruments linked to the price of natural gas. The terms of operation of the TGE Financial Instruments Market are similar to those applicable for years on the GPW futures market. The underlying instrument is the TGe24 index calculated on the basis of transactions at the first fixing on the Day-Ahead Market in electricity. Eligible as members of the TGE Financial Instruments Market are local and international investment firms and other buyers and sellers of financial instruments acting on own account, provided that they fulfil the conditions of trading on the regulated market.

The volume of trade was 1,488 MWh in 2015. The low turnover was mainly due to the early phase of growth of the market, the on-going acquisition of TGE participants and IRGiT clearing members, market education, as well high liquidity on the competitive forward market operated by TGE.

CLEARING

The Commodity Clearing House (IRGiT), which is a subsidiary of TGE, offers clearing of transactions of TGE members on its markets.

In 2015, IRGiT continued operations launched in 2010 as an exchange clearing house. Since 2010, IRGiT is authorised by the Polish Financial Supervision Authority to clear and settle transactions in financial instruments on the exchange and OTC regulated market.

Currently IRGiT clears the full volume of electricity and gas sold on the exchange market in Poland. The total volume of cleared transactions in electricity was 186.7 TWh while the total volume of cleared transactions in gas was 106.9 TWh in 2015.

Since 4 November 2015, based on state-of-the-art IT systems and a proprietary settlement model, IRGiT offers clearing and settlement of transactions in TGe24 futures on the TGE Financial Instruments Market. This is the first step in the development of services on the financial market in commodities. In the next step, clearing will be offered for financial instruments based on gas.

As a service complementary to the clearing of financial instruments based on commodities, IRGiT offers the reporting of trades on the financial market to a trade repository. In addition, IRGiT developed clearing of forward trades in RES Property Rights in 2015.