The GPW Group takes active efforts to unlock the full potential and grow its core markets in equities, debt, derivatives, commodities, and information services. The main objectives include the reinforcement of the key business segments of the exchange and the development of those areas where GPW has a competitive advantage and can effectively use the potential of its employees and assets. This section presents the key initiatives under the GPW.2020 strategy implemented in 2015 which help to grow the Group.

Technology and security

- 100 percent availability of GPW’s trading system – 100 percent availability of services provided by the GPW trading system was maintained in 2015, similar to 2014 (availability is understood as the ability to place orders, execute trades, set prices and publish market data).

- Colocation service – in H2 2015, GPW initiated work to re-launch the colocation service. The decision to offer the service addressed interest of several clients. In the service, the Exchange provides physical space and allows clients to install hardware and software in direct proximity to GPW’s trading system (UTP). The main benefit of the service for clients is minimum latency when placing orders or downloading market data. The technology of the colocation service to be offered by GPW as of Q1 2016 conforms to the standards of the biggest global exchanges. The objective of the service launch is to expand the offered access to the GPW markets in order to improve the liquidity of financial instruments.

- TGE trading system – on 8 January 2015, the Polish Power Exchange and Nasdaq extended the co-operation agreement to 2020 and confirmed that TGE will use the X-stream Trading Technology. The new technology will equip TGE with enhanced functionalities, enabling TGE to support steadily rising trading volumes and add more commodities and derivatives to its offer in the future. The agreement also allows TGE to use SAPRI, Nasdaq’s energy auction platform, as the Polish Power Exchange prepares to take part in European cross-border energy auctions in the PCR (Price Coupling of Regions).

- Risk Management Access (RMA) application – Risk Management Access (RMA), a solution developed and implemented by GPW and provided to KDPW_CCP, is available to GPW market participants since mid-August 2015. With the RMA application, each Clearing Member (including Exchange Members who hold the status and provide clearing services) can among others directly define the maximum limit of the value of orders placed by the Exchange Members whose trades it clears. Defined on an on-going basis, these parameters improve the efficiency of risk management, which helps to enhance market security. In addition to the filter configuration functionalities, the RMA application also offers the Kill Switch option to block the function of placing orders of an Exchange Member and cancel the Member’s active orders on the order book.

Equity market

- Reduction of transaction fees – in December 2015, GPW decided to reduce the fees charged on all orders for trade in shares, rights to shares and ETF units in the order amount up to PLN 100 thousand (from 0.033% to 0.029%). The fee reduction is available since 1 January 2016 for an undetermined period on the Main Market and NewConnect. GPW decided to reduce the transaction fees in reaction to changes in the capital market supervision financing system.

- 49 new listings on the two stock markets (including 13 companies which transferred from NewConnect to the Main Market) and took further measures to promote the exchange as a venue of raising growth capital for companies and local governments:

- “Capital for Growth” programme – a series of 16 meetings in Poland’s biggest cities in 2015, addressed to companies and local governments, promoting the role of the financial markets in raising capital for projects supported by EU funds in order to encourage companies and local governments to raise growth capital on the exchange. The events were attended by more than 1,200 participants.

- Liquidity of the Main Market in shares as measured by velocity increased to 36.7% in 2015 (34.7% in 2014) mainly as a result of:

- acquisition of new clients: exchange members, market makers, and participants of liquidity support programmes (HVP and HVF);

- continuation of trading fee promotion programmes;

- focused efforts to promote the Polish capital market and companies listed on the Warsaw Stock Exchange through a series of international investor conferences “Polish Capital Markets Days”.

- NewConnect 2.0 Programme – in May 2015, GPW announced the NewConnect 2.0 programme designed to activate the NewConnect market community in order to enhance the security and transparency of GPW’s alternative stock market. One of the pillars of the programme is the creation of an Authorised Advisers Board. Its responsibilities include to put forth proposed directions of development of the Alternative Trading System, to define guidelines for the activity of Authorised Advisers, and to issue opinions on amendments to laws and regulations concerning the organisation of the market. In December 2015, GPW introduced a new market practice on NewConnect to enhance the transparency of the process of introduction of companies to the alternative trading system. The rules of setting the date of the new listing and the method of GPW’s publication of information on submitted applications and information documents were amended. The modification was designed to improve the availability of information about issuers before their shares are first listed, and to activate investors.

- New Best Practice for GPW Listed Companies – on 13 October 2015, the Exchange Supervisory Board approved the new corporate governance code entitled “Best Practice of GPW Listed Companies 2016”. The new code took effect on 1 January 2016. The new document clarified a number of existing rules and imposed stricter requirements in selected key areas of corporate governance. At the same time, it followed the principle of adequacy by aligning the rules with the ability of companies of different sizes to ensure compliance. The document also included issues previously not covered by the corporate governance rules. All of the amendments to the Best Practice ensured continuation of the issues covered by the previous versions of the code.

- High Volume Funds Programme – on 1 July 2015, GPW launched High Volume Funds (HVF), the second liquidity support programme after the High Volume Provider (HVP) Programme, addressed to investment funds which actively trade in shares or derivatives on GPW. Similar to HVP, it is a fee promotion for those funds which generate daily trade in shares exceeding PLN 5 million or 150 futures and options. The velocity ratio of a fund, calculated as the generated turnover to the fund’s net asset value, is required to be at least 200 percent per month.

Debt market

- The number of new issues of non-Treasury debt in 2015: 23 issues, including 6 issues exceeding PLN 100 million each.

- Catalyst reform – as part of efforts designed to create an optimum operating model of Catalyst, solutions applied in Europe were reviewed and consultations with market participants were carried out. It is now an objective of GPW to simplify the Catalyst market structure by 2016 by separating two segments: the Treasury debt segment and the non-Treasury debt segment.

Derivatives market

- CFTC authorisation – after nearly three years of efforts, GPW was certified in 2015 by the US Commodity Futures Trading Commission (CFTC). As a result, WIG20 futures can be offered to US investors. GPW was CFTC certified in May 2015.

- High Volume Funds Programme – see the section on the equity market.

- Banks on GPW – GPW took active part in the drafting of regulations facilitating the access of banks to the exchange market. As a result, an Act of Parliament effective as of 1 November 2015 allows banks, without a separate brokerage licence, to operate directly on the regulated market on own account to the extent of debt instruments and debt, currency and interest rate derivatives.

- New single-stock futures – on 3 December 2015, to address investor interest, GPW introduced to trading six new classes of futures on stocks: Bank Millennium, Bank Zachodni WBK, Cyfrowy Polsat, CCC, Enea, and Energa. Following the addition of the new instruments, GPW listed 27 single-stock futures.

Commodity market

- TGE Financial Instruments Market – on 4 November 2015, TGE opened the Financial Instruments Market which offers trade in futures on the electricity price index TGe24 determined on the Day-Ahead Market. The electricity futures market offers trade in standardised futures on prices of energy to be delivered in the future. It is a platform of hedging against price risk without taking a position on the physical market, open to energy producers, traders and customers.

- Building up liquidity of the gas market – in 2015, TGE continued to focus on building high liquidity on the gas market. High turnover on the gas market would allow TGE to introduce gas derivatives with cash settlement and no physical delivery. In 2015, in the work of the Gas Market Committee and at dedicated seminars, TGE carried out preliminary consultations on the launch of a financial market in gas in Poland. The meetings with market participants helped to define the initial structure of natural gas futures. The structure of the instrument will be similar to derivatives available on the European gas market, where continuous quotations with physical delivery are the underlying.

- Extended trading on TGE energy and gas markets – as of 1 October 2015, in response to market participants’ expectations, TGE extended the trading hours on the energy and gas markets (the Intra-Day Market and the Day-Ahead and Intra-Day Market in Gas). The trading session on the markets closes at 15:30.

- TGE trading data reporting service – on 7 October 2015, TGE launched the TGE RRM trading data reporting service. The service addresses the Regulation of the European Parliament on Energy Market Integrity and Transparency (REMIT) which requires participants of the wholesale market in electricity and gas to report orders and transactions in those commodities on organised trading platforms.

- Green certificates futures market – in the final months of 2015, TGE was working to open trade in futures on property rights to certificates of origin of energy produced from renewable energy sources. TGE introduced the instruments on 12 January 2016. RES futures provide a market quote of the future price of property rights in RES and allow market participants to hedge the price and deliver property rights in the future.

Information services

- TGE data – as of 2014, GPW’s offer of real-time information from GPW and BondSpot markets includes commodity market data. The number of data subscribers increased by a high 50 percent in 2015.

- New products – in its efforts to establish an index and indicator competence centre in 2015, GPW introduced the service of providing historical data for the testing of automatic algo trading systems. Furthermore, analyses and consultations were carried out to implement a system of calculation and publication of indices and indicators available from the GPW Group.

- Non-display data – in 2015, in response to rising interest of investors using automatic trading, GPW initiated the sale of non-display data (i.e., data used by applications and not displayed).

New business areas

- Integration of post-trade services – in 2015, GPW analysed potential options of integration of post-trade services in Poland and increasing GPW’s exposure to the post-trade services segment.

- Other initiatives in implementation of new business lines:

- REIT (Real Estate Investments Trusts)1 market – in view of the large growth potential of the segment in Poland, GPW joined the work on the promotion of legislative amendments which would allow for REITs to be used in Poland, thus enabling local capital to have a bigger participation in income from real estate situated in Poland. The REIT market and regulatory model in selected countries were reviewed in the context of the investor potential, and a regulatory concept was developed and broadly consulted. The work in on-going.

- Covered bonds – GPW actively collaborated with a group of mortgage banks to develop optimal solutions for the development of the covered bonds market in Poland, facilitating issuer decisions to have covered bonds in currencies other than PLN listed on GPW. GPW also participated in consultations of draft legislative amendments. The amendment of the Act was signed into law in July 2015 (effective as of 1 January 2016).

[1] REIT (Real Estate Investments Trusts) are special companies and funds investing in real estate; they manage a real estate portfolio to earn a fixed income from rent, and pay out most of the earnings to shareholders as dividend. Polish law does not allow for the operation of REITs and limits pension funds’ investments in real estate. The global REIT market is worth US$ 1.5 trillion, including 64% in the USA and 12% in Asia and Europe each.

Operational effectiveness

- Cost optimisation – the GPW Group’s operating expenses decreased by PLN 7.2 million year on year. This was driven by a cost-saving programme including administration, IT, HR, real estate, and external service charges

- Integration of the GPW Group – in 2015, GPW initiated a programme in the Group designed to ensure efficient and effective support of GPW Group companies in their business areas by improving the quality, standardising the methods and scope of functions, eliminating duplication of activities, adequate use of available resources, cost cutting, standardisation and simplification of the information flow. The initiated projects include among others: harmonisation of accounting and financial processes, harmonisation of HR and payroll processes, development of a single controlling methodology, a shared system of electronic document flows, and the Group’s single corporate identity.

- Optimisation of the Group’s structure:

- 80.02% of Instytut Rynku Kapitałowego - WSEResearch S.A. was sold to Polska Agencja Prasowa S.A. in October 2015;

- 100% of WSEInfoEngine S.A. (now InfoEngine S.A.) was sold to TGE in August 2015 in order to concentrate commodity market assets within the TGE Group;

- GPW increased its equity investment in BondSpot from 92.96% to 96.98%;

- the search for investors for Instytut Analiz i Ratingu continued in 2015;

- following an increase of the capital of Aquis Exchange (associate) and GPW’s decision not to increase its investment in the company, GPW’s stake in the economic and voting rights decreased from 30.00% to 26.33%.

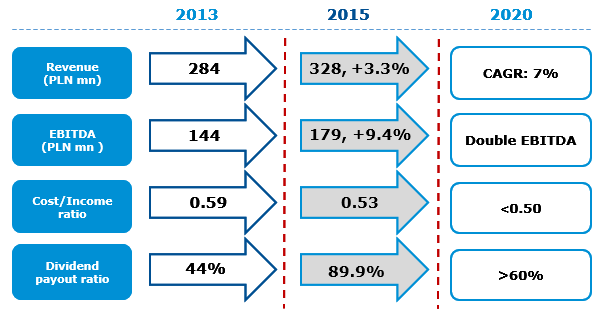

2015 at GPW Group versus ambitions resulting from strategy