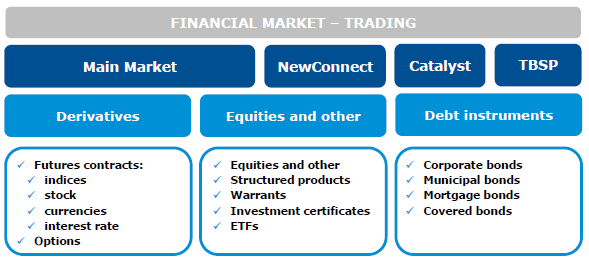

The activities of the GPW Group on the financial market include:

- trade in financial instruments on the regulated market and in the alternative trading system:

- trade in shares and other equity instruments on the Main Market and on the NewConnect market,

- trade in derivatives on the Main Market,

- trade in debt instruments on the Catalyst market organised by GPW and BondSpot and on Treasury BondSpot Poland (TBSP),

- listing, including introduction to trading and listing of financial instruments,

- information services including data from the financial and commodity markets.

TRADING

Trading encompasses trade in financial instruments on the Main Market and on GPW regulated markets NewConnect and Catalyst, and on Treasury BondSpot Poland.

Financial instruments in trading on the GPW Group financial markets

Stock Market

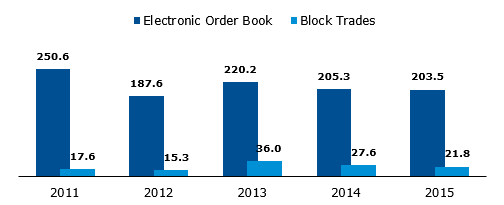

The total value of trade in shares on the Electronic Order Book (EOB) on the GPW Main Market was PLN 203.5 billion in 2014, a decrease of 0.9% year on year. The average daily value of trade was PLN 810.6 million, a decrease of 1.7% year on year. The number of transactions was 16.5 million in 2014, an increase of 19.5% year on year.

Value of trade in shares on the Main Market (PLN billion)

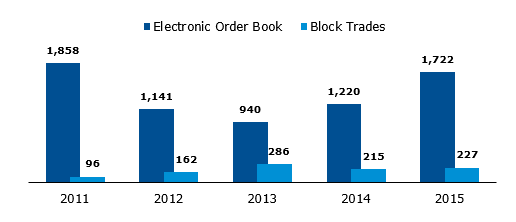

The value of trade on NewConnect increased in 2015. The value of trade in shares on the Electronic Order Book was PLN 1,722 million, an increase of 41.2% year on year; the value of block trades increased by 5.4% to PLN 227 million. The number of transactions on the Electronic Order Book was 1.1 million, an increase of 27.2% year on year.

Value of trade in shares on NewConnect (PLN million)

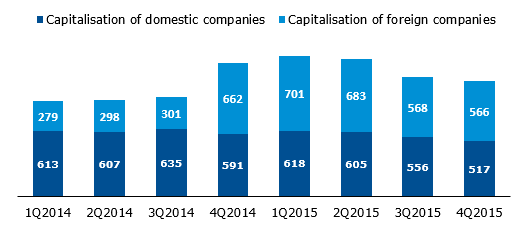

The decrease of turnover in shares on the GPW markets in 2015 was driven mainly by the difficult and demanding market conditions following the decline of the capitalisation of domestic companies as of Q1 2015. The capitalisation of domestic companies listed on the Main Market was PLN 591.2 billion at the end of 2014 and PLN 516.8 billion at the end of 2015 (a decrease of 12.6%).

Capitalisation of domestic and foreign companies on the Main Market (PLN billion)

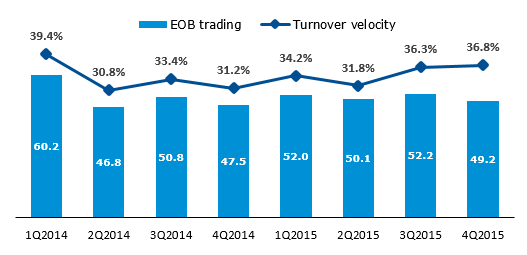

In spite of the sharp decrease of the valuation of GPW listed companies, turnover was not much different year on year (the value of trade in shares on the Electronic Order Book on the Main Market decreased by 0.9%) as a result of relatively strong investor activity. Velocity increased month after month in 2015 and reached 36.8% in Q4 2015, the highest level since Q1 2014.

Turnover in shares on the Main Market (PLN billion) and velocity (%)

This was largely driven by GPW’s focused efforts to build up liquidity by activating different groups of investors, including investors new to the Warsaw trading floor. These efforts included meetings with investors to promote small and medium-sized companies listed on GPW (the conference series Polish Capital Market Days), as well as special promotion programmes dedicated to active investors on the markets in shares and derivatives:

- High Volume Provider (HVP) Programme: the programme dedicated to entities investing only on own account was launched by GPW in November 2013 and continued until 31 October 2016. Eligible for promotion fees were investors who generate of turnover of at least PLN 5 million per session on the equity market or 150 thousand futures and options per session on the derivatives market.

- High Volume Funds (HVF) Programme: the programme was addressed to investment funds which actively trade in shares or derivatives on GPW. It was launched in July 2015 and continued until 30 June 2016. Similar to HVP, it is a fee promotion for those funds which generate daily trade in shares exceeding PLN 5 million or 150 futures and options. The velocity ratio of a fund, calculated as the generated turnover to the fund’s net asset value, is required to be at least 200 percent per month.

Both these programmes on the cash and derivatives markets jointly had 7 participants in 2015. There were 6 participants at the end of 2015 as one participant became a market maker on the cash market in September 2015.

The participants of both programmes generated 4.5% of the value of trade in shares on the Electronic Order Book in 2015; in the best months, their share exceeded 7% of turnover and 4.5% of the volume of trade in WIG20 futures.

Furthermore, GPW acquired new exchange members and market markets on the derivatives and cash markets in 2015, which helped to improve liquidity, and completed or initiated several projects to develop the GPW infrastructure, making it more accessible to global traders.

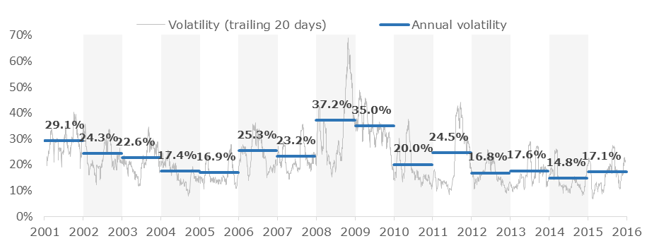

Growing volatility also supported the stable turnover despite the demanding market conditions. After very low volatility in 2014, it improved in the last two quarters of 2015, driving the activity of investors on the exchange.

Annual and short-term volatility of WIG20

In addition to the trading fee promotions under the HVP and HVF programmes, GPW trading participants benefited from other fee reductions as well. The fixed fee on orders on the market in shares, rights to shares and ETF units for EOB and block trades on the two stock markets was reduced from PLN 1 to PLN 0.20 and the same fee for orders of market makers to PLN 0.05; the reductions originally introduced in January 2013 continued throughout 2015. The reduction of the fixed fee was offered for an undetermined period.

Furthermore, on 3 December 2015, the GPW Management Board decided to reduce trading fees on transactions in shares, rights to shares and ETF for all orders, in the part of the order value up to PLN 100 thousand, from 0.033% to 0.029%. The reduction applies as of 1 January 2016 for an undetermined period on the Main Market and on NewConnect. GPW decided to reduce the trading fees in view of the change of the system of financing of capital market supervision. The structure of the reduction followed from consultations of GPW with the Chamber of Brokerage Houses.

The fee on market maker transactions in shares other than WIG20 shares (small and mid-caps) was reduced to zero from 1 July 2015 to 31 December 2015. At the request of GPW, KDPW_CCP waived market maker fees on transactions in shares other than WIG20 shares within that period. The market maker promotion was extended by GPW and KDPW_CCP until the end of Q1 2016.

Other Cash Market Instruments

The GPW cash market also lists structured products, investment certificates, warrants and ETF certificates.

Number of structured products, investment certificates, ETFs and warrants

| As at 31 December (#) | 2015 | 2014 | 2013 | 2012 | 2011 |

| Structured products (certificates) | 702 | 744 | 550 | 327 | 178 |

| Structured products (bonds) | 0 | 4 | 7 | 16 | 28 |

| Investment certificates | 30 | 31 | 37 | 58 | 60 |

| ETFs | 3 | 3 | 3 | 3 | 3 |

| Warrants | 0 | 76 | 72 | 68 | 90 |

In total, GPW listed 702 structured products, 30 investment certificates and 3 ETFs at the end of 2015, and the total value of trade in these instruments was PLN 1.1 billion in 2015, an increase of 46.1% year on year. Structured products had the biggest share in total trade (66.9%), followed by ETFs (25.4%).

Derivatives Market

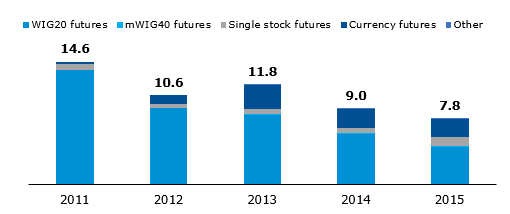

The Warsaw Stock Exchange operates the biggest derivatives market in Central and Eastern Europe. WIG20 futures have for years been the most liquid instrument that generates the highest volume of trading, representing 54.1% of the volume of trade in all derivatives in 2015 (63.7% in 2014, 65.4% in 2013, 80.1% in 2012).

Currency futures attract growing interest of investors: they accounted for 26.4% of the total volume in 2015. Single-stock futures are also increasingly traded (12.6% of the volume in 2015). Interest of investors in single-stock futures was record-high in 2015. The volume of trade in single-stock futures was more than 1 million contracts in 2015, an increase of 78.1% year on year. GPW offers futures on the stock of 27 companies, including 6 futures introduced to trading on 3 December 2015 in order to address rising investor interest. Growing demand for these futures follows rising needs of investors who must hedge their positions in view of the falling share prices. As short-selling opportunities on GPW remain limited, single-stock futures may gain even more popularity next year.

Structure of volume of trade in derivatives in 2015 by category of instrument

The volume of trade in WIG20 futures was 4.4 million instruments in 2015, a decrease of 26.4% year on year. As a result, the total volume of trade in derivatives was 8.2 million instruments in 2015, a decrease of 13.5% year on year. The number of open interest was 104.2 thousand as at 31 December 2015, a decrease of 24.5% year on year.

Volume of trade in futures, EOB and block trades, million instruments

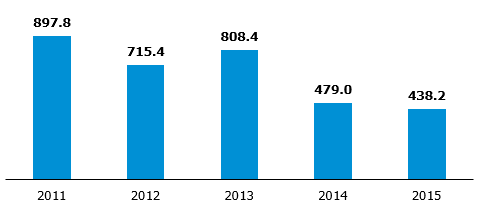

The total volume of trade in options was 438.2 thousand instruments in 2015, a decrease of 8.5% year on year.

Volume of trade in options, EOB and block trades, thousand instruments

The activity of investors on the derivatives market is largely driven by the volume of trade on the underlying instrument market but it is even more sensitive to volatility than investor activity on the cash market.

Similar to the cash market, GPW supports the liquidity of trade in derivatives by offering trading fee reductions and promotions. The following promotion fees for trading in futures were available on GPW as of 1 January 2013 and throughout 2014 and 2015:

- reduction of the fixed fee on index futures from PLN 1.70 to PLN 1.60;

- reduction of fees for day trading in futures on the Electronic Order Book (excluding transactions on the account of a market maker and transactions on own account of an exchange member);

- reduced fees for transactions in futures on own account of brokers.

In 2015, GPW continued to offer promotions for fees on market maker trade in WIG20 futures. As a condition of the promotion, market makers needed to generate a certain volume of trade. Furthermore, the fee charged from exchange members for trade in bond futures and WIBOR futures was reduced to zero from 1 November 2014 to 31 December 2015. The promotion was extended until the end of 2016.

Debt Market

The GPW Group offers trade in debt instruments on Catalyst, which is comprised of regulated and alternative trading systems operated on the trading platforms of GPW and BondSpot. The following instruments are traded on Catalyst:

- corporate bonds;

- municipal bonds;

- co-operative bank bonds;

- covered bonds;

- Treasury bonds.

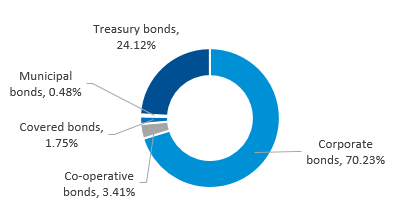

Structure of trade on Catalyst (EOB and block trades) in 2015 by instrument

The value of trade in non-Treasury instruments on the Electronic Order Book on the markets operated within Catalyst was PLN 1,554 million in 2015 as compared to PLN 1,728 million in 2014 (a decrease of 10.1%), and the value of block trades was PLN 359 million in 2015 as compared to PLN 776 million in 2014. The total value of trade in non-Treasury and Treasury instruments on Catalyst was PLN 2,521 million in 2015 as compared to PLN 3,116 million in 2014, representing a decrease of 19.1%.

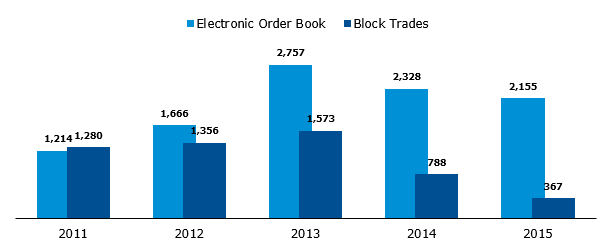

Value of trade on Catalyst, EOB and block trades, PLN million

According to the strategy GPW.2020 published in October 2014, the GPW Group plans to simplify the structure of the Catalyst market. Furthermore, as part of the efforts to promote new classes of instruments, GPW issued and introduced fixed-coupon bonds to trading in the GPW and BondSpot ATS.

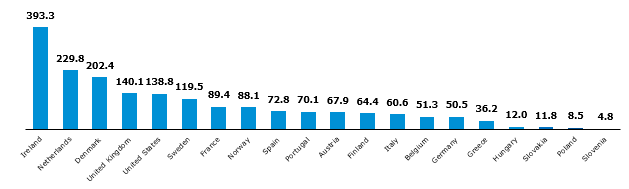

The total debt of Polish companies and financial institutions under debt instruments (maturities above 1 year) outstanding on the local and international markets represented 8.5% of GDP at the end of 2015.

Outstanding bonds of financial and non-financial institutions to GDP (%)

Source: Fitch Polska (as at December 2015); other markets: Bank of International Settlements (as at June 2015, financial and non-financial institutions)1; GDP: Eurostat (2014); USA: World Bank (2014)2

Catalyst also has a growth potential created by regulatory requirements. A new law effective as of 1 November 2015 allows banks, without a separate brokerage licence, to operate directly on the regulated market on own account to the extent of debt instruments and debt, currency and interest rate derivatives. Following the pension fund reform of February 2014, funds are barred from investing in Treasury bills and other debt instruments guaranteed by the State Treasury, which turns them to the corporate bond market.

Treasury BondSpot Poland

Treasury BondSpot Poland (TBSP) is an integral part of the Treasury Securities Dealer system in Poland, established to minimise the cost of public debt by improving liquidity, transparency and effectiveness of the Treasury securities market. TBSP includes a market of cash transactions and a market of conditional transactions.

TBSP offers trade in Treasury securities (Treasury bonds and bills). TBSP listed 31 series of Treasury bonds with a nominal value of PLN 512.1 billion at the end of 2015. No Treasury bills were traded at the end of 2015. TBSP also offers trade in EUR Treasury bonds. The market listed 14 series of EUR Treasury bonds with a nominal value of EUR 29.4 billion at the end of 2015.

In 2015, TBSP held the status of electronic market within the Treasury Securities Dealer System, the reference platform of secondary trading in Treasury debt (the selection is made once every three years by the Treasury Securities Dealer System and approved by the Minister of Finance). The next tender for the reference platform of secondary trading in Treasury debt took place in January 2016. As a result, TBSP will hold the status of reference platform for another three years (ending on 30 September 2019).

Treasury BondSpot Poland held 251 trading sessions in 2015. The total number of transactions was 19.6 thousand. The total value of trade was PLN 599.4 billion, a decrease of 21.8% year on year. The share of cash transactions and conditional transactions in total trade was 43.5% and 56.5%, respectively, in 2015.

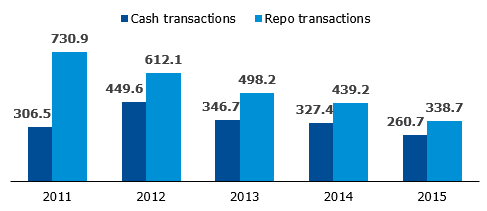

Value of trade on Treasury BondSpot Poland (PLN billion)

The value of cash transactions in PLN instruments was PLN 260.6 billion in 2015, a decrease of 20.4% year on year. The value of conditional transactions was PLN 338.7 billion in 2015 (a decrease of 22.9% year on year). The activity of market participants was driven by both global factors and developments directly related to the Polish financial market. The local bond market was driven by global capital flows resulting from the activity of the main central banks working towards recovery of growth and prevention of deflation (on the one hand, end of easing by the Fed; on the other hand, quantitative easing measures taken by the Bank of Japan and expected easing by the ECB). This influenced bond yields and prices on the core markets, which in turn impacted the yields and prices in Poland. The yields of Polish bonds were also driven at first by rate cut expectations and then by decisions of the Monetary Policy Council (RPP). The value of trade on the bond market was largely driven by changes in the pension fund system, which ended trading in Treasury securities by this group of institutional investors. In addition, the Ministry of Finance largely limited the origination of bonds in the latter half of the year, which affected the value of trade on the secondary market.

As at the end of 2015, TBSP had 33 market participants (banks, credit institutions, investment firms), including:

- 20 market makers on the cash market, including 15 Treasury Securities Dealers;

- 6 market takers on the cash market;

- 7 institutional investors (1 on the institutional cash market, 5 on the cash and conditional market, 1 on the cash market).

LISTING

Listing encompasses admission and introduction to exchange trading and listing of securities on the markets organised and operated by the GPW Group.

GPW listed 905 companies at the end of 2015 (487 companies on the Main Market and 418 on NewConnect), including 64 foreign issuers (902 listings including 61 foreign issuers at the end of 2014).

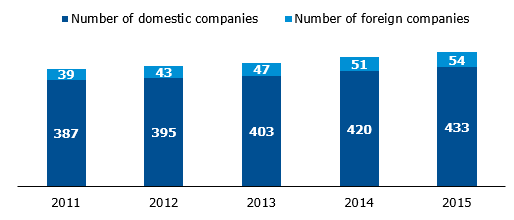

Number of domestic and foreign companies – Main Market

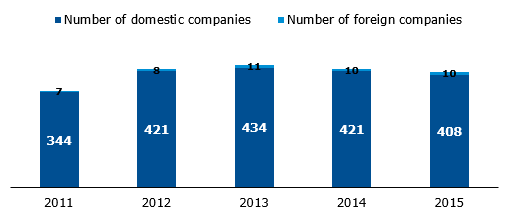

Number of domestic and foreign companies - NewConnect

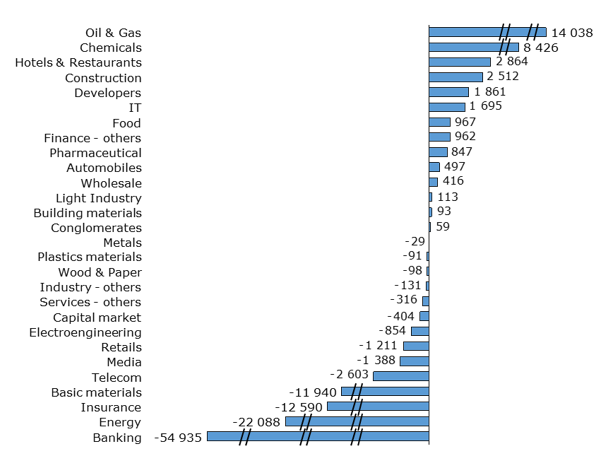

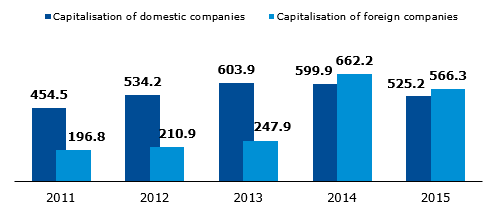

The total capitalisation of domestic and foreign companies on GPW’s two equity markets was PLN 1,092 billion at the end of 2015 compared to PLN 1,262 billion at the end of 2014. The decrease of capitalisation starting after Q1 2015 was different in different sectors. The biggest year-on-year decrease of capitalisation was reported in the banking sector (down by PLN 54.9 billion), the energy industry (down by PLN 22.1 billion), and the insurance sector (down by PLN 12.6 billion). The biggest increase of capitalisation in 2015 was reported by the fuel industry (up by PLN 14.0 billion).

Change of capitalisation of domestic companies in 2015 by sector (mn PLN)

Capitalisation of domestic and foreign companies – Main Market and NewConnect (PLN billion)

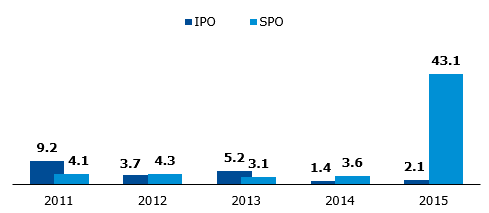

In spite of the unfavourable market conditions, IPO and SPO activity of issuers was stable year on year in 2015. There were 49 IPOs on GPW’s two stock markets in 2015 (including 13 companies which transferred from NewConnect to the Main Market), compared to 50 IPOs in 2014. The total value of IPOs on the two stock markets was PLN 2.1 billion and the value of SPOs3 was PLN 43.1 billion in 2015. Poland’s ECM (Equity Capital Market) was worth PLN 6.03 billion in 2015 (source: Dealogic).

In view of its fundamental mission – to provide companies with growth capital – GPW is engaged in on-going initiatives to promote the capital market as a source of financing for Polish companies and local governments. In 2015, GPW completed a major project addressed to potential issuers: “Capital for Growth”. This series of 16 meetings in Poland’s biggest regional capitals from May to November 2015 promoted the role of the financial markets in raising capital for projects supported by EU funds in order to encourage companies and local governments to raise growth capital on the exchange. The events were attended by more than 1,200 participants: businesses, local governments, non-governmental organisations, universities and the media.

[3] Two SPOs of Banco Santander SA in Q1 2015 at PLN 33 billion in aggregate

Value of IPOs and SPOs – Main Market and NewConnect (PLN billion)4

[4] Two SPOs of Banco Santander SA in Q1 2015 at PLN 33 billion in aggregate

Four foreign companies were newly listed on GPW’s two stock markets in 2015, and 64 foreign issuers were listed on GPW at the year’s end.

The number of IPOs on NewConnect decreased for a second consecutive year in 2015. There were 19 IPOs, including one foreign company, compared to 22 IPOs in 2014. Thirteen issuers transferred from the alternative market to the Main Market. With 418 listings (including 10 foreign companies), the capitalisation of NewConnect was PLN 8.7 billion at the end of 2015.

The nominal value of non-Treasury debt listed on Catalyst was PLN 69.6 billion at the end of 2015, an increase of 8.6% year on year. Catalyst listed 496 series of non-Treasury debt instruments at the end of 2015. Issuers whose instruments were listed at the end of 2015 included 19 local governments, 148 enterprises and 22 co-operative banks. Including the State Treasury, the number of issuers on Catalyst was 192 at the end of 2015, compared to 193 at the end of 2014. The total nominal value of non-Treasury and Treasury debt instruments listed on Catalyst was PLN 613.1 billion at the end of 2015, as compared to PLN 544.6 billion at the end of 2014.

INFORMATION SERVICES

GPW collects, processes and sells data from all of the markets operated by the Group. The status of GPW as the original source of information on trading and its strong brand and diversified business activity within the GPW Group enable the Company to successfully reach various groups of market participants with advanced information adjusted to individual needs. The main clients using information provided by GPW are specialised data vendors who deliver the data made available by the Company in real time to investors and other market participants. Amongst the vendors there are information agencies, investment firms, internet portals, IT companies and other entities.

As at 31 December 2015, the Company’s information services clients were 54 data vendors, including 30 domestic and 24 foreign ones, with nearly 221.1 thousand subscribers (including 15 thousand subscribers using professional data feeds). At the end of 2015, GPW had data vendors in such countries as the United Kingdom, the USA, France, Germany, Switzerland, Austria, Denmark, Sweden, Norway, Ireland, the Netherlands, and Cyprus.

As of 2014, following a co-operation agreement signed with the Polish Power Exchange, GPW’s offer of real-time information from GPW and BondSpot markets includes commodity market data. The number of data subscribers increased by a high 50 percent in 2015. The sale of commodity market data has a strong growth potential in the coming years, driven among others by trade in commodity derivatives settled in cash, offered by TGE as of November 2015.

In 2015, GPW was working to acquire customers of non-display data and signed the first contracts. GPW also acquired three new licensees of GPW indices used as the underlying of financial products.

Number of data vendors and subscribers, as at 31 December

| 2015 | 2014 | 2013 | 2012 | 2011 | |

| Number of real-time data vendors | 54 | 58 | 58 | 58 | 57 |

| - local | 30 | 31 | 34 | 37 | 37 |

| - international | 24 | 27 | 24 | 21 | 20 |

| Number of real-time data subscribers (thousand) | 221.1 | 240.3 | 261.9 | 288.1 | 327.3 |

| - number of subscribers using professional data feeds | 15.0 | 15.1 | 16.2 | 16.3 | 19.1 |

| Number of licensees using GPW indices as underlying instruments of financial products | 18 | 16 | 17 | 17 | 18 |

In addition to quotation data, the Company also provided data vendors in 2015 with reports of issuers listed on NewConnect and Catalyst.

The Company’s information services also include:

- delivery of GPW statistics and indicators;

- services for licensees issuing financial instruments with the use of GPW indices as underlying instruments;

- licences on GPW data for use in the calculation and publication of clients’ proprietary indices;

- calculation of indices for clients;

- licences for television stations using real-time data feeds for limited presentation in public financial programming.