A key goal of the GPW Group according to the strategy approved in October 2014 is to make the Warsaw trading floor a market of first choice for investors and issuers in Central and Eastern Europe

GPW’s international position is mainly reinforced with on-going expansion of the foreign client base including issuers, brokers, investors and data vendors, as well as initiatives designed to promote the Polish market and Polish companies among international investors.

In 2015, GPW continued its efforts to promote the Polish market and GPW-listed companies internationally. Representatives of the Exchange successfully promoted the Polish capital market, with a focus on small and medium-sized companies listed on GPW, by holding investor events in partnership with brokers and investment banks around the world and by participating in international conferences and investor meetings.

The investor event series Polish Capital Markets Days co-organised by GPW in 2015 included five meetings: in the UK, the USA, Warsaw, Austria, and France. The events brought together 100 Polish companies which met with 252 investors at 900 one-on-one meetings.

The GPW Group also participates in international projects and initiatives for the commodity market, mainly focusing on the integration of European energy markets.

GPW REPRESENTATIVE OFFICES IN LONDON AND IN KIEV

The Representative in London was appointed in June 2013 to enhance GPW’s acquisition activities on that market. In 2015, the Representative focused on supporting relations with GPW’s business partners including exchange members, investors and providers of technology services for GPW and its clients.

Since 2008, GPW has operated a Representative Office in Kiev (Ukraine), whose operations focus on promoting GPW amongst Ukrainian investors, issuers and financial intermediaries.

The two Representative Offices have no separate legal personality and do not carry on any profit earning independent business operations. In all their activities, the Representative Offices act on behalf and for GPW to the extent of powers of attorney granted by the GPW Management Board.

DEVELOPMENT OF A NETWORK OF FOREIGN INVESTMENT FIRMS – EXCHANGE MEMBERS

International sales initiatives in 2015 focused on clients and partners who represent a potential of growing the liquidity on the markets operated by GPW.

In 2015, GPW expanded its acquisition activities addressed to GPW’s business partners including existing and prospective exchange members, investors and providers of technology services.

In 2015, GPW acquired three new remote exchange members: Spire Europe Ltd., SUN Trading Ltd., Credit Suisse International; as a result, GPW had 57 members, including 29 local members and 28 remote members, at the year’s end. GPW acquired two new market makers on the cash market and one new market maker on the derivatives market. The share of remote exchange members in trade increased, mainly driven by the participation of their clients in the HVP (High Volume Provider) Programme. The share of remote members in EOB trade in shares was 25.1% in 2015 compared to ca. 21.7% in 2014.

Share of local and remote GPW members in trade in shares on the Main Market

| 2015 | 2014 | 2013 | 2012 | 2011 | |

|---|---|---|---|---|---|

| Local | 74.9% | 78.3% | 77.8% | 89.0% | 92.0% |

| Remote | 25.1% | 21.7% | 22.2% | 11.0% | 8.0% |

In 2015, GPW established relations with several new independent software vendors (ISV), including a provider of a popular derivatives trading application for professional traders. The alignment of applications provided by different ISVs with GPW’s trading system helps to facilitate access to GPW markets and expand the base of potential clients interested in trading on the Warsaw Stock Exchange.

In 2015, GPW was certified by the US Commodity Futures Trading Commission (CFTC), authorising GPW to offer WIG20 futures to US investors. In August 2015, following joint efforts of GPW and KDPW, ABN Amro Clearing Bank became a KDPW_CCP member as the first Global Clearing Member (GCM), expected to reach operational readiness for clearing in Q2 2016. To address demand from clients, GPW reactivated the colocation service in 2015. The first colocation contracts are expected to be signed in 2016.

ATTRACTING FOREIGN ISSUERS

One of the key goals of the GPW Group’s strategy is to strengthen the position of the regional financial hub by making the Warsaw Stock Exchange the market of first choice for investors and issuers in Central and Eastern Europe. In 2015, GPW actively pursued new issuers and organised events targeting issuers in Lithuania, Serbia, Slovenia, Ukraine, as well as meetings with foreign companies interested in raising capital. GPW also reinforced its direct relations with investment banks active in CEE.

In 2015, three foreign companies were newly listed in the Main Market: Uniwheels (Germany), Prairie Mining Limited (Australia), and Kofola Ceskoslovensko (Czech Republic), which jointly raised PLN 1,269 million of capital. As at 31 December 2015, the markets operated by the Exchange listed shares of 64 foreign companies, including 10 companies listed on NewConnect, with total capitalisation of nearly PLN 566.3 billion, compared to PLN 662.2 billion in 2014 (a decrease of 14.5%). The share of foreign companies in total trade in shares on the Main Market was 1.8% in 2015 as compared to 1.9% in 2014. Foreign companies listed on GPW as at 31 December 2015 originate from 24 countries, mainly Ukraine (13 issuers) and the Czech Republic (7 issuers). 34 companies are dual-listed and 30 are single-listed on GPW.

SHARE OF FOREIGN INVESTORS IN TRADING ON GPW MARKETS

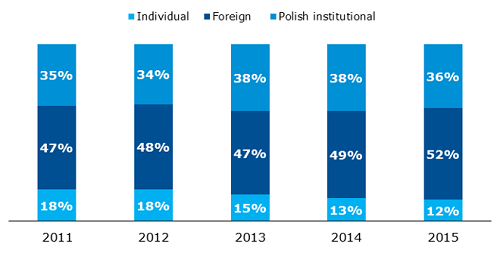

According to GPW’s research, foreign investors generated 52% of turnover in shares on the GPW Main Market in 2015, 3 percentage points more than in 2014 (49%).

Share of investors in trade in shares on the Main Market (%)

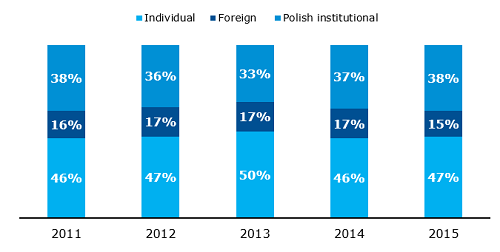

Foreign investors’ share in the futures market decreased to 15% in 2015 compared to 17% in 2014.

Share of investors in trade on the futures market (%)

CO-OPERATION BETWEEN GPW AND EBRD

Since July 2015, GPW and the European Bank for Reconstruction and Development (EBRD) are engaged in a joint project of drafting a report which compares the key competitive drivers of the Polish capital market and GPW with other markets. The findings will be used in the debate on the European initiative of a Capital Market Union and in the dialogue with institutions in the regulatory and market environment. The objective is to draft necessary legislative amendments and provide tools supporting further development of the Polish market.

INTEGRATING THE EUROPEAN ENERGY MARKET

TGE has for years been actively involved in the activity of regional and European markets, participating in projects and initiatives aimed at integrating the European energy market. This provides TGE with the contractual and technical capacity of active and full participation in projects which develop European markets, as well as on-going access to know-how, certificates and technologies necessary to offer exchange services on selected EU markets. The key projects of TGE in 2015 included the following:

- TGE joined the Price Coupling of Regions (PCR) as co-owner of the day-ahead market software. TGE is one of the eight co-owners of the market algorithm and as such it can actively and fully participate in regional projects. TGE will become a full member of the PCR project and the MRC market as an exchange co-ordinating market processes subject to specific technical requirements. The process will be finalised in H2 2016.

- TGE joined Multi-Regional Coupling (MRC) which ensures co-ordination of the European day-ahead market. The Multi-Regional Coupling market was founded through integration of regional markets in 2014-2015 and continues to expand. The European project of operational integration of electricity spot markets spans a territory where demand for electricity is ca. 2,800 TWh, equal to 85% of total European demand. This is Europe’s biggest and most liquid market. Poland participates in MRC through the Swe-Pol Link and the LitPol Link. In July 2015, TGE became a full member of the MRC market and signed the Day-Ahead Market Operations Agreement, which supports the co-operation of 12 energy exchanges and 25 transmission system operators.

- TGE became NEMO for the Polish energy market on 2 December 2015, authorising it to operate single coupling of European energy markets (Day-Ahead Market and Intra-Day Market) in the Polish pricing zone for four years ending on 2 December 2019. As NEMO, energy exchanges can operate a national market (Day-Ahead Market and Intra-Day Market) and participate in the joint cross-border market coupling mechanism.

THE GPW GROUP AS A MEMBER OF INTERNATIONAL ORGANISATIONS AND INITIATIVES

FESE

The Warsaw Stock Exchange has co-operated with the Federation of European Securities Exchanges (FESE) since 1992. GPW was granted the status of associated member in 1999 and has been a full member of FESE since June 2004. FESE represents 37 exchanges which organise trading in equities, bonds, derivatives and commodities through 19 full members from 30 countries as well as 1 affiliated exchange and 1 non-European observer member.

Capital Market Union

In 2015, the Warsaw Stock Exchange was involved in consultations of the Capital Market Union project, designed to create a single capital market across the 28 European Union member states. GPW welcomed the Green Paper which provides for a greater role of the capital market in financing of the EU economy, especially SMEs. In the opinion of GPW, the main objective is to support initiatives which facilitate market access, improve market transparency and encourage mid-term and long-term investing. However, the Capital Market Union concept should take into account the importance of regional capital markets to the national economies.

Sustainable Stock Exchanges (SSE)

GPW is a member of the Sustainable Stock Exchanges (SSE) since December 2013. SSE is a UN initiative of global exchanges which promote the development of corporate social responsibility and sustainable development on their home capital markets. SSE was created in 2009 by the United Nations to exchange members’ experience in the development and promotion of corporate social responsibility and responsible investment among investors, public companies, regulators and capital market infrastructure institutions. GPW was the ninth exchange to join SSE, the first one in Central and Eastern Europe. SSE has 35 members.

FIX Trading Community

In 2014, GPW became a member of the FIX Trading Community. The non-profit industry organisation brings together close to 300 financial companies: banks, exchanges, brokers, buy-side and ISV. It supports the dialogue and exchange of information on good practice and standards of information exchange on the financial market. The flagship achievement of the FIX Trading Community is the creation and development of the FIX information exchange protocol broadly used by financial companies.

Association of European Energy Exchanges EUROPEX

EUROPEX is the association of European commodity and financial energy exchanges which represents exchange markets in electricity, gas and derivatives. TGE is a EUROPEX member since 2005. In 2015, TGE President Ireneusz Łazor was re-elected for a second two-year term on the EUROPEX Board.

The mission of EUROPEX is to enhance competition on the European market by ensuring transparent price setting and implementing a single European market in electricity and gas enabling convergence of prices as well as benefits for customers. EUROPEX participates in the development of market solutions and engages in dialogue with EU authorities and other European institutions which contribute to the development of the markets.

Association of Power Exchanges (APEx)

The Association of Power Exchanges (APEx) is an international organisation of world energy exchanges and transmission system operators. It has 50 members around the world. APEx supports the development of energy markets. Its key initiatives include development of a platform for exchange of information and experience among its members. TGE is an APEx member since 2000.

Association of Futures Markets (AFM)

AFM is an organisation of 26 financial and commodity exchanges around the world. AFM holds its AFM Annual Conferences as a platform for exchange of information and experience between exchanges. The mission of the Association is to promote and encourage the development of new derivatives markets and to support their growth. TGE is an AFM member since 2014. In 2015, TGE Vice President Michał Tryuk was elected to the AFM Board.

Thanks to close cooperation between TGE and AFM, the AFM Board selected TGE as the host and co-organiser as the 18th AFM Annual Conference in Poland in 2015.

EACH – European Association of CCP Clearing Houses

IRGiT representatives take part in plenary meetings, teleconferences and work of the Policy Committee, the Risk Committee and the Legal Committee of the European Association of CCP Clearing Houses EACH. IRGiT takes active part in consultations of draft European regulations.