The European market is dominated by several large exchanges which participated in consolidations and now decide about the directions of development of the single energy market and its technologies. Nord Pool Spot (present in Norway, Sweden, Finland and Denmark) has expanded to the Baltic states (Lithuania, Estonia, Latvia); APX-Endex has expanded to the UK and has a presence in the UK, Belgium and the Netherlands; EPEX Spot has expanded to France (presence in Germany, France, Switzerland and Austria).

In the course of consolidations on the European market, smaller exchanges may lose their footprint, especially where their local markets are statistically and geographically small. With a very liquid energy market and good geographic location in Central and Eastern Europe, TGE aspires to be one of the major exchanges. The strategy and action plans of the GPW Group follow the framework proposed by the European Commission and the European Council including implementing measures of the European internal energy market and regional markets. The Agency for the Co-operation of Energy Regulators (ACER) launched in March 2011 works together with national energy regulators to initiate changes in the models used on the local markets.

Integration of the European energy market is underway. The European Commission and the European Council have confirmed the expected start date of the internal energy market by the end of 2016. Integration will begin at the regional level, followed by pan-regional integration. The objective of the implementation of the European internal market is to improve the cross-border energy exchange capacity, to maximise social welfare for participants through rational costs of production and purchase and price convergence, and to create regional and EU service synergies ensuring energy security.

Energy Market in Europe

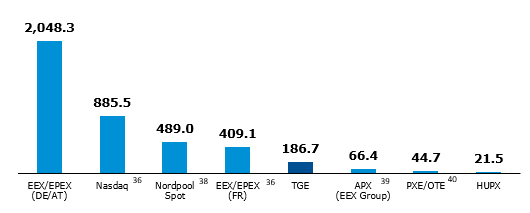

The volume of trade in electricity on TGE positions the Polish exchange as one of the largest players in the region and a major player in Europe. Considering that the products offered on TGE come from the Polish market alone while other European exchanges combine the volume of trade from many countries, the volume of trade on TGE confirms its strong and stable position in Europe. The total volume of trade in electricity was 186.7 TWh in 2015, a decrease of 0.1% year on year.

Volume of trade in electricity on European exchanges in 2015 (TWh)

Source: Zajdler Energy Lawyers & Consultants based on exchange data.

[1] With its international presence in many European countries, EPEX Group has been split into markets. The Group’s total turnover on all markets in 2015 was 3,061.5 TWh

[2] Nordic and German markets

[3] Turnover including N2EX (UK)

[4] Following changes to ownership and organisation, APX is presented as the sum of the Netherlands and Belgium markets

[5] PXE joined the EEX Group at 20.01.2016. Data for the Czech spot market (OTE) and PXE markets.

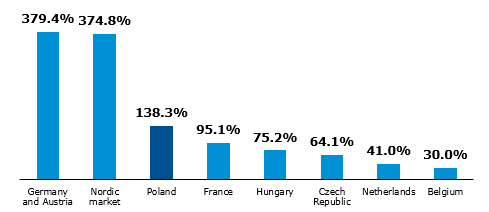

Liquidity on the energy markets in Central and Eastern Europe has been rising dynamically, mainly due to an early phase of development compared to the fully mature German and Scandinavian markets. The high growth rate favours the convergence of CEE exchanges and the exchanges of Northern and Western Europe. Liquidity on TGE in 2015 was second only to the German-Austrian and Scandinavian markets.

Liquidity of electricity markets in 20156

Source: Zajdler Energy Lawyers & Consultants based on exchange data. Consumption according to Enerdata and statistical offices.

[6] Turnover on the exchange (spot + forward) to consumption. Consumption data for 2014. Due to modifications of EEX’s presentation methodology (OTC cleared by the exchange included in the volume), the data are not directly comparable with 2014. Data for the Scandinavian market include Norway, Sweden, Denmark, Estonia and Latvia. Data for the German-Austrian market based on EEX/EPEX and Nasdaq OMX volumes. In view of the high volume of Hungarian contracts on PXE, these are shown under the Hungarian market. Netherlands and Belgium turnover based on APX data for those markets

Gas Market in Europe

The liquidity of the gas market in Poland has grown sharply since mid-2014, supported by the statutory requirement to sell a proportion of gas on the exchange.

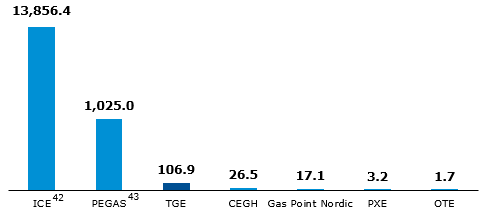

Volume of trade on European natural gas markets in 2015 (TWh)

Source: Zajdler Energy Lawyers & Consultants based on exchange data.

[8] Data for all PEGAS markets

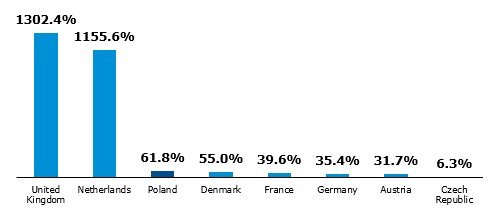

The liquidity of the Polish gas market in 2015 positioned TGE as a top three market as measured by the rate of turnover to consumption. The UK market has traditionally been the best developed gas market in the European Union, followed by the Netherlands; now Poland ranks third, ahead of large economies such as Germany and France.

Liquidity of gas markets in 20159

Source: Zajdler Energy Lawyers & Consultants based on exchange data. Consumption according to Eurogas.org

[9] Turnover on the exchange (spot + forward) to consumption. Consumption data for 2014. Data for the Netherlands market based on ICE and PEGAS. Data for other markets based on PEGAS (France, Germany), ICE (UK), TGE (Poland), CEGH (Austria), Gas Point Nordic (Denmark), PXE and OTE (Czech Republic). 2015 data for Hungary not available