25 years of experience, security of trade, operational excellence and a wide range of products make GPW one of the most recognised Polish financial institutions world-wide.

The leading entity of the GPW Group is the Warsaw Stock Exchange, which has helped Polish companies to grow for 25 years, enabling them to raise capital for investments, job creation, international expansion, research and development. Thanks to the developed capital market infrastructure and the strength of the local economy, investors from around the world have invested their capital in Polish companies. Another major source of capital are the savings of nearly 20 million Poles managed by domestic investment funds and pension funds.

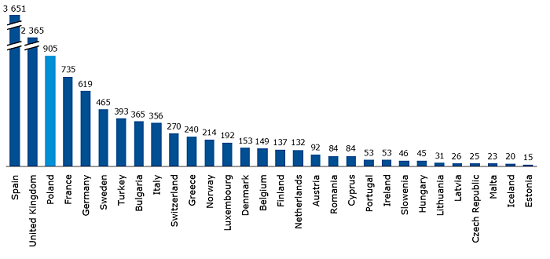

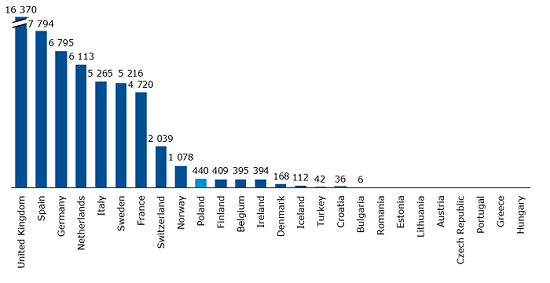

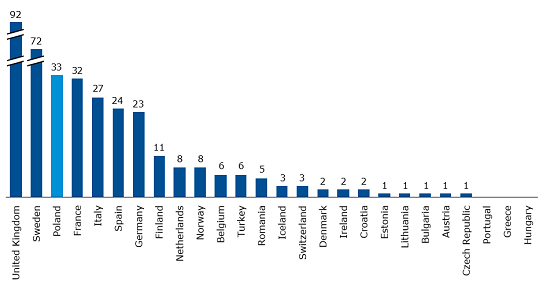

Companies listed on the exchange are the biggest investors in Poland, which makes them a key driver of the economic growth of the regions. Listed companies employ more than 776 thousand people in Poland, i.e., approximately 14% of the total workforce of the corporate sector (source: Central Statistical Office, PwC, 2015). In 2015, companies newly listed on GPW’s stock markets and their owners jointly raised EUR 440 million of capital, which ranks Poland #10 in Europe. As measured by the number of IPOs, Warsaw came third in Europe after London and Stockholm. The strong interest of local and regional companies in listing on GPW has for many years strengthened the position of the Exchange as one of Europe’s leading and CEE’s top market by the number of listed companies. The markets operated by GPW offer trade in stocks and bonds of nearly one thousand local and international issuers. Most of the issuers are small and medium-sized companies of Polish origin.

The Exchange also offers trading in debt instruments, derivatives and structured products, and promotes economic education through the GPW Foundation.

Number of companies listed on European exchanges1 at the end of 2015

Source: FESE, websites of Euronext, LSEG, Nasdaq

[1] France, the Netherlands, Belgium, Portugal – Euronext, Sweden, Denmark, Finland, Iceland – Nasdaq, Estonia, Latvia, Lithuania – Nasdaq Baltic.

Value of IPOs on European exchanges in 2015

Source: PwC IPO Watch Europe 2015

Number of IPOs on European exchanges in 2015

Source: PwC IPO Watch Europe 2015

Acting through the Polish Power Exchange (TGE) the GPW Group makes a major contribution to the liberalisation of Poland’s energy and natural gas markets and helps to improve the country’s energy security. TGE is an active participant of the European energy market as a member of PCR (Price Coupling of Regions) and supports trade via the link with Sweden and Lithuania. It is also an important part of the national support scheme for the production of energy from renewable sources and cogeneration.

The Polish Power Exchange operates one of the most liquid electricity markets in Europe. In addition to trade in electricity, the commodity market also offers trade in natural gas, property rights in certificates of origin, as well as CO2 emission allowances. In 2015, TGE opened its Financial Instruments Market which offers trade in electricity futures. TGE also operates a Register of Certificates of Origin and a Register of Guarantees of Origin; through the subsidiary Commodity Clearing House (IRGiT), it clears transactions on the TGE commodity and financial markets.

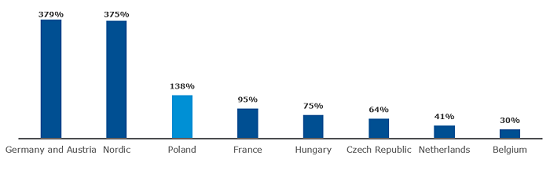

Liquidity on electricity markets in 20152

Source: Zajdler Energy Lawyers & Consultants based on exchange data. Consumption according to Enerdata and statistical offices

[2] Liquidity understood as turnover to national consumption of electricity. Consumption data for 2014. Due to modifications of EEX’s presentation methodology (OTC cleared by the exchange included in the volume), the data are not directly comparable with 2014

[3] Data for the German-Austrian market based on volumes of EEX/EPEX and Nasdaq OMX

[4] Denmark, Estonia, Latvia, Norway, Sweden

[5] In view of the high volume of Hungarian contracts on PXE, these are shown under the Hungarian market

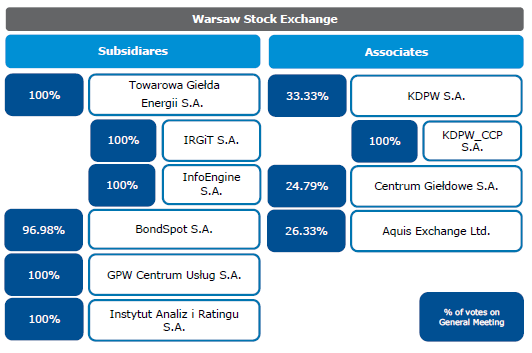

Post-trade services for the financial market operated by GPW and BondSpot, including depository, clearing and settlement services, are offered by GPW’s associate, the Central Securities Depository of Poland (KDPW), and its subsidiary KDPW_CCP S.A.

The Warsaw Stock Exchange Group was comprised of the parent entity and four consolidated subsidiaries as at 31 December 2015. GPW holds a stake in three associates.

GPW Group and associates

Core business of GPW Group companies

| Subsidiary | Business profile |

|---|---|

| BondSpot S.A. | Operates trade in Treasury and non-Treasury debt securities. Holds the status of electronic market in Treasury securities authorised by the Ministry of Finance and the Treasury Securities Dealers. |

| Towarowa Giełda Energii S.A. (Polish Power Exchange, TGE) | The only licensed commodity exchange in Poland, operates trade in exchange-traded commodities: electricity, natural gas, emission allowances, property rights in certificates of origin of electricity, certificates of origin of biogas, energy efficiency certificates; operates the Register of Certificates of Origin of electricity generated from renewable energy sources and high-efficiency co-generation, agricultural biogas and energy efficiency certificates; operates the Register of Guarantees of Origin; opened the Financial Instruments Market in 2015. |

| Izba Rozliczeniowa Giełd Towarowych S.A. (Commodity Clearing House, IRGiT, a subsidiary of TGE) | Operates a clearing and settlement system for transactions in exchange commodities and financial instruments other than securities. |

| InfoEngine S.A. (a subsidiary of TGE) | Operates an electronic OTC commodity trading platform, provides services to electricity market participants. |

| GPW Centrum Usług S.A. | Provides a financial and accounting system to GPW Group companies. |

| Instytut Analiz i Ratingu S.A. (IAiR) | It is planning to develop and public ratings for companies and local governments. GPW is seeking partners/investors for the endeavour. |

In addition, GPW holds 19.98% of InfoStrefa S.A. (formerly Instytut Rynku Kapitałowego – WSE Research S.A.), 10% of the Ukrainian stock exchange INNEX PJSC and 1.3% of the Romanian stock exchange S.C. SIBEX – Sibiu Stock Exchange S.A. Furthermore, GPW operates a representative office in Kiev. The parent entity has no branches or establishments.